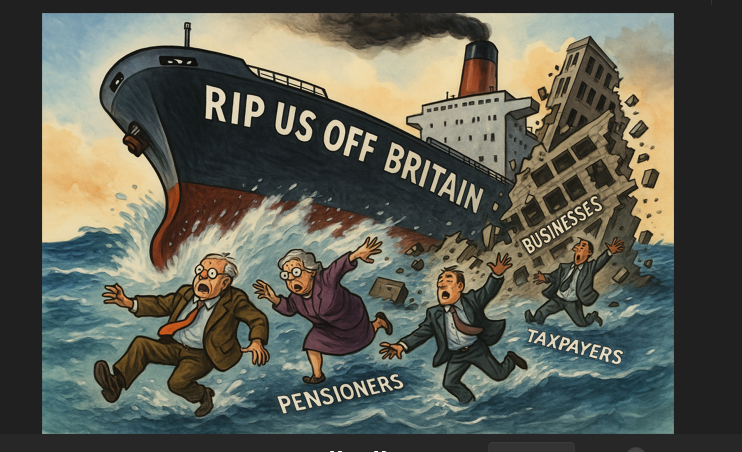

THE SUPERTANKER EFFECT

Welcome to the first Blog Post for- RIPusOFFBRITAIN

If you've ever felt ripped off by big corporations, gouged by greedy supermarkets, or bled dry by government and council schemes, you're not alone. The system is designed to squeeze every last penny from the public, while those at the top rake in the profits, dodge accountability and laugh all the way to the bank.

This blog exists to expose the lies, the scams and the back door deals that leave ordinary people worse off, I'll be digging into the ways we're manipulated, overcharged and misled - whether it's hidden fees, dodgy policies or outright fraud disguised as "business as usual" no sugar coating, no corporate spin, just the truth about how we're being scammed and shafted. So if you're tired of this never ending clawing away of our money and being taken for fools, you're in the right place, stay tuned, stay informed and most importantly-"keep calm"

The American statesman, Benjamin Franklin once wrote in a letter, In this world Nothing is certain in life, except “Death & Taxes”, that was back on November 13th 1789 It has been a phrase most commonly used for the last 236 years, I’ve often wondered if that phrase should have been the other way round “Taxes & Death” or even “taxed to death” because you would have had to pay those taxes first, before you popped your clogs. John Marshal, also an American, jurist and former United States Secretary of State concluded “the power to tax is the power to destroy” and that just about sums it all up. Here is my short aphorism-“earn or spend, tax won’t end” short witty, and memorable, could this phrase be repeated for the next 236 years? There is now no such thing as a fair tax, it has now gone way beyond those boundaries. The UK tax system is like a monstrous unstoppable supertanker barreling forward, crushing workers, businesses, Farmers and pensioners under its relentless weight, no matter how much we pay, the demand for more money never stops.

We are Scammed, shafted and totally ripped off, every day, every week, every month, year in, year out. It's constant and it is not going to stop. Governments who, with their taxing agenda upon the British public are a number one factor when it comes to the cash grab, and it seems that since the Labour party took over Government back in June 2024, the financial future of the British public is extremely concerning for us all. The cost of living is rocketing and for those of us who have to pay our hard earned cash in tax, just out of sheer greed, want even more money from us and it seems that there is nothing we can do about it, if we want to stay and live in the UK. We can complain, we can question and we can moan about it, but it will, at the end of the day, just fall on deaf ears. The “Government” say, it’s rebuilding the foundations starting from scratch and wants to put more money in the working people’s pockets, do we really and honestly believe that, I think for most of us, it is just “pie in the sky” seems those responsible for all these increases are never affected financially , the basic annual salary for a labour MP since April 2024 is now £93,904, the PM annual salary is £172,153 plus additional payment for any appearances or work done outside their duties, not to mention all the freebies and the many perks they get, can't be bad, nothing to worry about there.

The past and even more importantly, the present, it is an extreme financial situation for all of us, particularly those who are on the minimum wage and just above, it's the constant pressure with the cost of living that can cause a lot of stress through hardship, basic needs become a struggle for those who cannot afford their rent or mortgage, or even their daily meals, some are forced to choose heating or eating during the colder months, difficulty affording fuel, vehicle maintenance or having to pay for public transport and of course there is the physical and mental health decline, medical neglect, skipping doctors visits, dental care or prescriptions due to the cost, poor nutrition, relying on cheap unhealthy foods can also lead to health issues, especially if there is a family to support, there is also the sleep problems, stressing about money can cause insomnia and fatigue and of course it goes on and on.

Even the rich people amongst us are being affected, past and present governments (Labour, the worst ever, are what the people are saying) will often tax the wealthy more, especially during economic downturns, most of them will be hit by government tax increases, inflation erodes cash savings, forcing the wealthy to constantly shift their money into assets, property, stocks and commodities, the super rich who rely on UK property investments face instability due to fluctuating interest rates, housing policies and global economic shifts, stamp duty will be increased in April 2026, Labour has also hyped up national insurance contributions for employers, and upped the minimum wage which is affecting companies in a big way, this is also having a negative form on recruitment because of the increases for business.

Over 10,000 millionaires have left the UK now, and more are leaving on a daily basis, the forecast for the outflow is expected to be around 16,500, some are heading to the United Arab Emirates (UAE) including Dubai, Malta and the Italian Riviera, which is even more worrying for those of us who are left here, as we will have to pay an even bigger price because of their departure from Britain, the loss of their money to the treasury will leave a massive hole that we the over-paying tax payer will have to fill.

The Great British Tax Trap, how the UK bleeds you dry compared to the rest of the world.

This is where we expose how everyday Brits are being shafted by the very systems meant to serve them. Today’s topic, Income tax, not vat, not fuel duty, not council tax, (that will come in a later blog) just the so called “progressive” income tax system.

We are all familiar with the word Tax. In plain English, you earn, they take. No choice, no opt-out. It’s “compulsory” A Tax is essentially a forced payment to the government taken from your income, your purchases, or your property, whether you like it or not. It’s not a donation, It’s not a contribution, it’s a demand backed by law, and if you don’t pay you’re penalized, fined, or even jailed. According to the Oxford English Dictionary it defines a tax as: “A compulsory contribution to state revenue, levied by the government on workers income and business profits, or added to the cost of some goods, services and transactions.

We know that taxes have existed in various forms in the UK for over a thousand years. The earliest taxation in the UK was the 9th- 10th centuries (Anglo-Saxon England): The Danegeld was one of the earliest forms of tax and land tax levied to pay off Viking raiders. Modern day Income Tax was first introduced 1n 1799 by the Prime Minister William Pitt Younger during the Napoleonic war. The rate was 2 old pennies in the pound on incomes over £60.00 It was intended as a temporary measure, sold as a wartime fix, it was repealed in 1802, and reintroduced in 1803, repealed again, and then permanently reinstated in 1842 by Sir Robert Peel as again a “temporary measure” but the tax has stayed in place ever since, and will be for another thousand years and beyond. So how many additional UK taxes have been added to squeeze us dry.

- Personal direct tax.

- National Insurance Contributions (NICs).

- Taxes on business people.

- Stamp duty & property/Land taxes.

- Taxes on dividends.

- Council taxes.

- Excise duties.

- Value added taxes (VAT20%).

- Insurance premium tax.

All the above taxes are on top of our Income tax, but it doesn’t stop there, eighteen months ago when labour won the general election, promises were made before and on the run up, but since they have been in power, there has been a financial meltdown which is having a devastating ripple effect across the whole of the UK.

The UK has a progressive income tax system, it’s not one of the highest taxed countries overall, but it has a relatively high tax burden compared to some other developed nations, for most UK earners the rates would be 20%, 40% and 45% National Insurance (NI) contributions add an extra 8% to 10% for many workers, middle earners in the UK often pay more tax than in countries like the US or Australia.

Here’s how it’s supposed to work:

- Personal allowance: The first £12,570 you earn is tax free.

- Basic rate: (20%) from £12,571 to £50,271

- Higher Rate: (40%) from £50,271 to £125,240

- Additional rate: (45%) on anything above £125,240

Sounds fair, right? The more you earn, the more you pay. Except…

- Once you earn over £100,000, you start losing your personal allowance that means for every £2 you earn above £100k, you lose £1 off your tax-free amount.

- This creates a hidden 60% tax free for earnings between £100k

- Add in National Insurance and frozen tax bands until 2028 and you’ve got a recipe for stealth taxation.

- So if you’re lucky enough to be earning £125,000 then you will have ZERO- ALLOWANCE, now is that fair, personally I don’t think that is fair (and I’m earning just over the minimum wage) but I still think that you should not lose your personal allowance of £12,570, I know many would disagree, thing is if you are in this bracket, then you will fall into the 60% tax trap and will pay tax on every penny that you earn, not to also mention the national insurance deductions. This will cost you thousand’s.

These figures are from the reed.co.uk site.

Reed state that the above figures quoted, are for guidance only and does not in any way constitute financial advice, they advise you to consult a specialist regarding any major financial decisions, the above rates are from the HMRC website and are correct as from 16th June 2025, along with the exclusions. The Tax calculator can be found on this site.

Incidentally (my opinion) for all those who are on £25K and under per year, there should be “NO TAX” to pay’

Here are some International Comparisons: Are we being mugged off?

So let’s see now the UK stacks up against other countries:

Germany

- Tax starts low at 14% and rises to 45%.

- A separate solidarity surcharge and church tax make it even pricier.

- BUT: their bands rise more gradually and workers get more in return (healthcare/pensions)

- China

- Progressive rates from 3% to 45%

- Huge earners do pay, but enforcement varies

- Big push on tax reform and compliance

Hong Kong

- Flat and low

- choose between 15% flat or progressive up to 17%.

- No tax on global income, dividends or capital gains tax

- It’s efficient, simple and fair.

France

- 0% to 45%, but social charges, add 17% more.

- High tax burden, but more services.

- Complex, but family-orientated system.

Spain

- Top rate: up to 47% depending on your region.

- Wealth tax for the rich

- High youth unemployment, means fewer tax payer's

Italy

- 23% to 43%, plus reginal taxes.

- High evasion, especially among the wealthy.

- Middle earners feel the pinch hardest

Pakistan

- Top rate is 35% but few actually pay it.

- The rich and the powerful often dodge the taxes.

- Salaried workers end up shouldering the burden.

India

- Two systems: Old (with deductions).

- New: Lower rates, (with no deductions).

- Up to 30% top rate.

- Complex, paperwork-heavy and favours the elite

So, what makes the UK particularly rotten.

- Stealth taxes via frozen thresholds.

- 60% effective rate in the £100k-£125k bracket.

- Ridiculously complex: over 10,000 pages of tax code.

- Benefits the rich with accountants and shafts the middle earners.

So who’s really paying?

If you’re a salaried worker earning between £45K and £125K, you are the tax donkey of Britain, you don’t qualify for enough benefits to get any help, and you don’t earn enough to exploit loopholes. You’re stuck in the middle-squeezed very hard and totally ignored.

Meanwhile, billionaires set up trusts, funnel their cash offshore, and enjoy capital gains tax rates well below what you would pay on income. It’s not a system. It’s a racket.

How does this sound : R.O.T "RESISTANCE TO OVER TAXATION" of course in a mild non violent way, just having our say to all the rot we've had to put up with over the years as regard to being ripped off through the tax system and more.

I am going to end this blog here, but would like to add, that I do want to continue talking about the UK tax system in future blogs and at some point, actually creating my very own "FAIRER TAX SYSTEM" and how it should work for the people of the UK, what do you think? Give me your opinions.